- Strategic Solutions For Financial Growth

Navigate Complex Financial Challenge With Confidence

- About Us

Who We Are

Our Mission

To be the most reliable tech-driven insurance grievance resolution platform that enhances customer confidence and policy management. We aim to simplify the insurance experience while ensuring justice for policyholders.

Our Mission

To be the most reliable tech-driven insurance grievance resolution platform that enhances customer confidence and policy management. We aim to simplify the insurance experience while ensuring justice for policyholders.

- OUR SERVICE

Services Offered by Nidaan Desk

Insurance Policy Assessment & Analysis

Claims Management & Dispute Resolution

Grievance Redressal

Mis-selling Identification & Recovery Assistance

Insurance Literacy & Advisory

Post-Claim Support

Insurance Policy Assessment & Analysis

Claims Management & Dispute Resolution

Grievance Redressal

Mis-selling Identification & Recovery Assistance

Insurance Literacy & Advisory

Post-Claim Support

- Categories

Service Categories for Nidaan Desk

Insurance Broking & Sales (Regulated Activity)

- Partnering with licensed brokers to offer policy comparisons and purchases.

- Custom recommendations from multiple insurers (neutral, need-based advice).

- Annual policy review and renewal management.

Renewal Management Services

- Auto-reminders for premium due dates.

- Evaluation of changing coverage needs at renewal time.

- Seamless renewal filing assistance.

Claims Concierge (Premium Tier)

- Full-cycle white-glove claim handling for high-value policies.

- Representation during hospital pre-authorization or insurer surveyor meetings.

- Claim tracking dashboard with real-time status updates.

Underwriting Advisory for Clients

- Helping clients understand insurer risk criteria before applying.

- Risk profile review to improve chances of approval or better premiums.

Documentation & Application Filing

- Assistance in proposal forms, KYC, declarations, and health documentation.

- E-filing or physical documentation support.

Corporate & SME Insurance Services

- Group Mediclaim, Group Life, Liability, and Workmen Compensation support.

- Employee onboarding, claims coordination, and exit support.

- Custom analytics on usage trends and premium optimization.

- Business & Finance Solution

Insurance Broking & Sales (Regulated Activity)

- Partnering with licensed brokers to offer policy comparisons and purchases.

- Custom recommendations from multiple insurers (neutral, need-based advice).

- Annual policy review and renewal management.

- Business & Finance Solution

Renewal Management Services

- Auto-reminders for premium due dates.

- Evaluation of changing coverage needs at renewal time.

- Seamless renewal filing assistance.

- Business & Finance Solution

Claims Concierge (Premium Tier)

- Full-cycle white-glove claim handling for high-value policies.

- Representation during hospital pre-authorization or insurer surveyor meetings.

- Claim tracking dashboard with real-time status updates.

- Business & Finance Solution

Underwriting Advisory for Clients

- Helping clients understand insurer risk criteria before applying.

- Risk profile review to improve chances of approval or better premiums.

- Business & Finance Solution

Documentation & Application Filing

- Assistance in proposal forms, KYC, declarations, and health documentation.

- E-filing or physical documentation support.

- Business & Finance Solution

Insurance Broking & Sales (Regulated Activity)

- Partnering with licensed brokers to offer policy comparisons and purchases.

- Custom recommendations from multiple insurers (neutral, need-based advice).

- Annual policy review and renewal management.

- Business & Finance Solution

Renewal Management Services

- Auto-reminders for premium due dates.

- Evaluation of changing coverage needs at renewal time.

- Seamless renewal filing assistance.

- Business & Finance Solution

Claims Concierge (Premium Tier)

- Full-cycle white-glove claim handling for high-value policies.

- Representation during hospital pre-authorization or insurer surveyor meetings.

- Claim tracking dashboard with real-time status updates.

- Business & Finance Solution

Underwriting Advisory for Clients

- Helping clients understand insurer risk criteria before applying.

- Risk profile review to improve chances of approval or better premiums.

- Business & Finance Solution

Documentation & Application Filing

- Assistance in proposal forms, KYC, declarations, and health documentation.

- E-filing or physical documentation support.

- Business & Finance Solution

Corporate & SME Insurance Services

- Group Mediclaim, Group Life, Liability, and Workmen Compensation support.

- Employee onboarding, claims coordination, and exit support.

- Custom analytics on usage trends and premium optimization.

- Business & Finance Solution

Regulatory Representation

- Drafting complaints to IRDAI, Ombudsman, or consumer court (non-litigious support).

- Evidence compilation and procedural guidance.

- Business & Finance Solution

Regulatory Representation

- Mapping current policies vs. actual needs (Life, Health, Property).

- Identifying overlaps, underinsurance, or unnecessary coverage.

- Business & Finance Solution

Wellness & Risk Mitigation Advisory

- Connecting health insurance clients with wellness programs.

- Risk prevention education (fire safety, health monitoring, etc.).

- Business & Finance Solution

Corporate & SME Insurance Services

- Group Mediclaim, Group Life, Liability, and Workmen Compensation support.

- Employee onboarding, claims coordination, and exit support.

- Custom analytics on usage trends and premium optimization.

- Business & Finance Solution

Regulatory Representation

- Drafting complaints to IRDAI, Ombudsman, or consumer court (non-litigious support).

- Evidence compilation and procedural guidance.

- Business & Finance Solution

Regulatory Representation

- Mapping current policies vs. actual needs (Life, Health, Property).

- Identifying overlaps, underinsurance, or unnecessary coverage.

- Business & Finance Solution

Wellness & Risk Mitigation Advisory

- Connecting health insurance clients with wellness programs.

- Risk prevention education (fire safety, health monitoring, etc.).

Client Success Stories

Nidan Desk Insurance turned my insurance nightmare into a success story. After Star Health Insurance wrongly rejected my claim, I reached out to them. They provided clear, step-by-step guidance, leading my case to the Insurance Ombudsman in Guwahati. Thanks to their expertise, I secured my claim—minus consumables.

Good overall experience, helped me get the claim amount on which I had given up all hope. They take around 18% of the overall claim amount and a 500 registration fee but provide very good and professional service. If you are also facing any issues related to an insurance claim, get a Samadhan from Nidan Desk.

Our Standardized Process

Step 1

Policy Intake & Assessment

- Collection of policy documents and claim details.

- Legal and risk-based analysis by our expert team.

- Preliminary report outlining issues and recommended approach.

Step 2

Case Structuring & Communication

- Drafting of representations, justifications, and declarations.

- Timely, professional correspondence with insurance companies.

- Provision of expert-reviewed evidence and medical/legal documentation.

Step 3

Claim or Dispute Handling

- Case negotiation with insurer.

- Filing grievances or appeals in accordance with IRDAI timelines.

- Application for Ombudsman or legal intervention if required.

Step 4

Resolution & Closure

- Recovery of rightful compensation or formal decision.

- Final documentation and closure report.

- Post-case review and customer feedback.

Mis-selling: What It Means & How We Help

- Selling policies with hidden exclusions.

- Falsely claiming guaranteed returns or coverages.

- Policy sold without explaining surrender charges, premium terms, or benefit limitations.

How Nidaan Desk Supports Mis-selling Victims:

- Detailed review of sale documentation, call recordings, and agent behavior.

- Filing of refund or compensation requests with the insurer.

- Formal complaint submission to IRDAI or the Insurance Ombudsman.

- Legal representation and recovery process support.

Advanced & Future-Focused Services Nidaan Desk Can Explore

Policy Structuring & Gap-Filling

- Custom structuring of insurance portfolios across multiple providers.

- Recommending top-ups, riders, or balance cover to bridge underinsured gaps.

- “Insurance Portfolio Wellness” checkups annually.

Legacy Planning & Nominee Guidance

- Assistance in setting up beneficiaries, nominations, and will alignment.

- Post-claim guidance for nominees (especially elderly/single heirs).

Emergency Assistance Services

- Dedicated helpline or mobile app for hospital admissions, FIR filing, roadside assistance, etc.

- Geo-tagging integration for emergency alerts (especially for motor/travel claims).

Legal Support Tie-Ups (Non-litigious)

- Partnering with legal advisors to offer demand notices, arbitration assistance, and settlement consultancy for complex disputes.

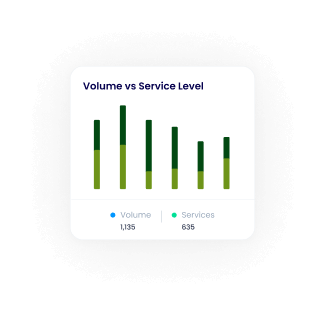

Insurance Claim Data Analytics (For Enterprises)

- Predictive insights for HR heads or insurers (non-personalized, anonymized).

- Trends in claim types, denial rates, and average settlement times.

Policy Translation & Accessibility Services

- Translating policy documents into regional languages for better understanding.

- Audio summaries for visually impaired or senior clients.

Premium Financing Assistance

- Partnering with NBFCs/FinTechs to offer premium EMIs or credit facilities for high-ticket policies.

Claim Simulation Tool (Consumer-facing AI/Chatbot)

- Users can simulate “If I file this claim, how likely is approval?” Based on past trends, policy structure, and claim size.

Pre-Insurance Medical Check-Up Coordination

- Doorstep health check-ups via diagnostic partners.

- Report collection and digital submission to insurer on behalf of client.

Policy Structuring & Gap-Filling

- Custom structuring of insurance portfolios across multiple providers.

- Recommending top-ups, riders, or balance cover to bridge underinsured gaps.

- “Insurance Portfolio Wellness” checkups annually.

Legacy Planning & Nominee Guidance

- Assistance in setting up beneficiaries, nominations, and will alignment.

- Post-claim guidance for nominees (especially elderly/single heirs).

Emergency Assistance Services

- Dedicated helpline or mobile app for hospital admissions, FIR filing, roadside assistance, etc.

- Geo-tagging integration for emergency alerts (especially for motor/travel claims).

Legal Support Tie-Ups (Non-litigious)

- Partnering with legal advisors to offer demand notices, arbitration assistance, and settlement consultancy for complex disputes.

Insurance Claim Data Analytics (For Enterprises)

- Predictive insights for HR heads or insurers (non-personalized, anonymized).

- Trends in claim types, denial rates, and average settlement times.

Policy Translation & Accessibility Services

- Translating policy documents into regional languages for better understanding.

- Audio summaries for visually impaired or senior clients.

Policy Translation & Accessibility Services

- Translating policy documents into regional languages for better understanding.

- Audio summaries for visually impaired or senior clients.

Expert Financial Advice And Business Tips

Building a Stronger Business with Sound Financial Practices Mastering Financial

The world of business finance is evolving rapidly. Our blog keeps you ahead of the curve by exploring the latest […]

Actionable Insights to Strengthen Your Business’s Financial Health Optimizing

Whether you’re a startup or a established company, having the right financial strategies is essential to long-term success.